Cash is king

Use it or lose it!

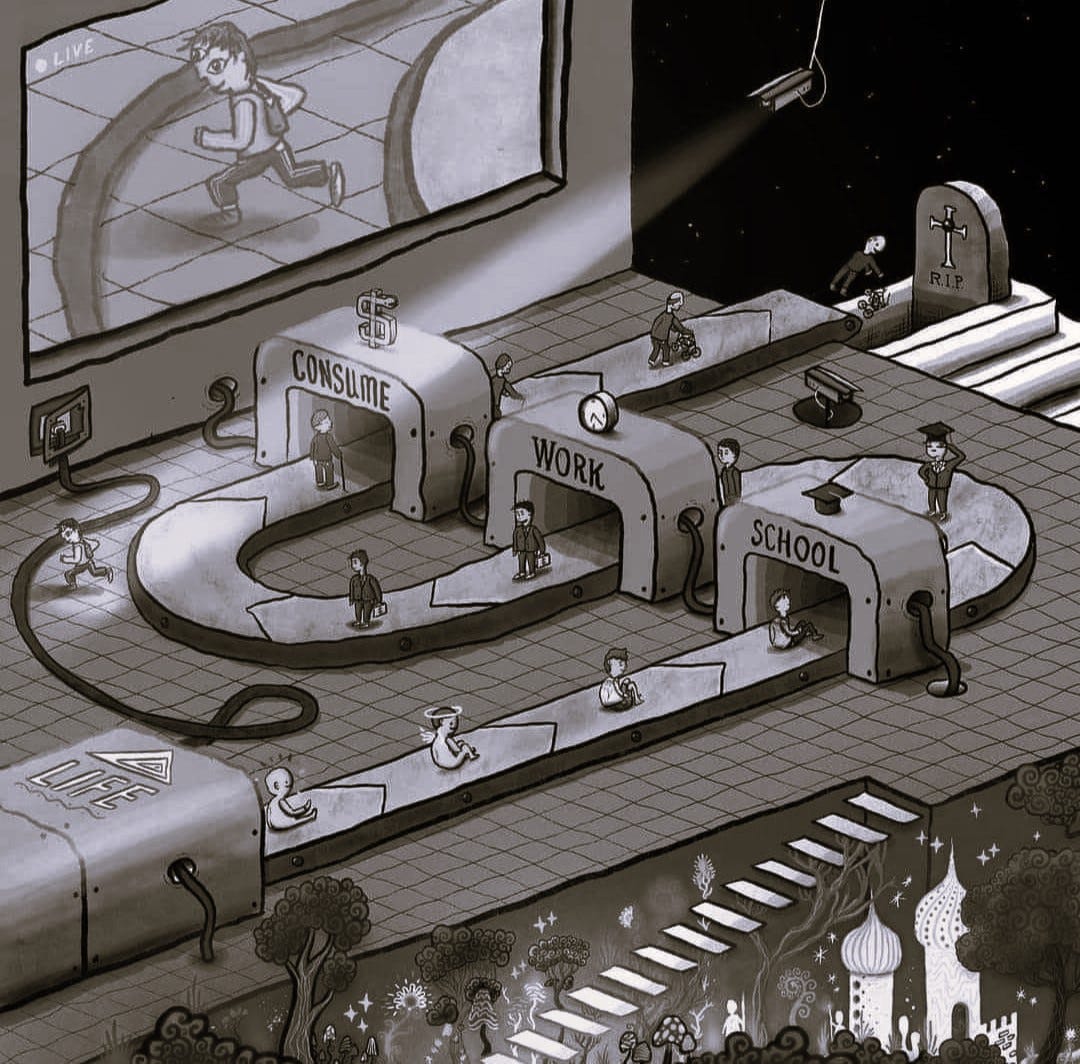

Throughout society there are many ways of income transfer to pay for goods and services. All forms of these purchases have their positives and their negatives. Generally, the big end of town as known as corporations and governments will highlight the negatives of using cash to suit their own needs. Which in turn generates more wealth which in today's society means power. But does that suit the little guy? Does that suit you? Centralizing everything chops a lot of competition out of the picture meaning there is one thing left for the more powerful top end of town to do: Rise prices on their products.

Cash is still very much used in our society. According to the Reserve Bank of Australia (RBA), there are over 2 billion banknotes circulating, worth more than $100 Billion. That's around $4,000 per person in this country. Break this down even further and you get the average person in Australia that has 18 $100 notes and 38 $50 notes each. That's very much so, a lot of cash.

We all know what happened in March of 2020 and all have certain opinions to what transpired. What also happened around this time was the amount of physical cash in Australia increased meaning the reserve bank and commercial banks had to store more cash in their vaults to keep up with demand. This could be something which occurs once again if similar circumstances occur.

Not only more cash was in society, but also larger notes as per graph. One RBA survey held in 2020 found that 56% of respondents stored cash outside of a bank and that interestingly as much as 15% of the total figure was held overseas. People from many demographics and cultures in this country including perhaps a few of you who are reading this, began to prepare for the worst mainly due a to lack of confidence when it came to stability across the globe. Many of these added bank notes are still around in society today.

Stigma around the use of cash more times than not, driven by the media where they reach a point of people thinking of it as “dirty money” insinuating things such as “the only people who still use cash are drug dealers” as well as all of a sudden a hygiene element regarding the handling money which was going to make everyone sick and put lives at risk, something we all can look back on today and shake our heads.

Cash is still very much used in remote communities where issues of weather events, power outages and poor internet exists. Teenagers and young adults within these communities count it as second nature because they have grown up within a cash system. On the flip side, over reliance of technology has literally lowered the IQ when it comes to basic maths of many whom live in the cities as more and more of this next generation struggle when they are handed a pineapple (or known as a $50 note).

I was astounded when just under a month ago on November the 8th, I watched an old man struggle to use an ATM. The lineup was 6 deep by this stage, and he was apologizing to all who suddenly required cash due to random EFTPOS failures all across Australia. One telecommunications provider, one massive stick in societies economic cog grinding it to a halt. If they remove cash completely, then what are we to do in this situation?

People of Mount Isa (and surrounding areas) in Northwestern QLD know about this too well having on occasions power outages as their Diamantina Power Station has issues or struggles to keep up with demand. This remote part of the grid still very much requires cash to function. The more coastal regions of North QLD, Cairns and Townsville have significant weather events causing disruptions not just to their electricity but also their telecommunication networks meaning the local people have it in its best interest keeping cash within their possession and also within their community. This year in April, the people of Cairns Regional Council rallied together to reinstate cash as a payment method after the council itself tried to have it removed. In something which belongs to the people it’s silly to impose EFTPOS fees on a $2 purchase at the buyback shop (basically the shop that sells recycled goods, often called a tip shop) when card payment is all that's available. This logical, common-sense approach from the local community which took 5,000 signatures to the council was successful, and Cairns Regional Council now has Cash re-instated as a form of payment.

With it being unclear how much each Australian spends on ATM fees and tap and go card surcharges it could be well assumed that if 19 million Australian adults along with many working teenagers cut these fees out of their budget the economy would be stimulated as everyone would (on average) have more money to spend. Therefor on the flip side, these fees are of course contributing to inflation. The elderly and ethnic communities all very much so rely on cash as they either struggle to grow with technology, do not have a strong level of trust in such a digital system or in fact have religious beliefs against earning interest off the fake fiat cash system. The Muslim communities in Australia hold these beliefs and perhaps this is why they are fonder to hard real value commodities rather than a fiat currency.

So why not go one step further and use cash to our advantage? I mean once again. When I grew old and comfortable enough to move out of home, it was cash which I paid for a spot within a share house. Years later I lived and paid cash rent to a tradie whom also favored jobs which paid cash not only to end up with more of an income overall, but to lower the time spent on accounting putting it through the system. When running a small business, no matter what it is, the more time you spend on providing the goods or service to the community the more profit you will make. Consider whether the time “Running the books” is dead money or not? Today we are seeing small family shops offer a 10% discount on purchases when paying via cash. Something one could believe in the context of today in Australia is a very good move.

What if one day Cash is GONE?

Some within our society who are the most vulnerable rely on cash. If the vulnerable rely on it to provide basic needs, then how can we even consider perhaps rewarding a busker for their efforts? He or she through this reward system could be encouraged to continue on and one day be able to make a solid income through their talents as they grow in confidence. They may even approach competitions showcasing their skills.

In Southport (Gold Coast QLD) there is a lad who washes windscreens sometimes in close to 40'c heat just to make a dollar. He is a man with a very positive attitude and is just having a go! Something we have always valued here in Australia. Two $2 coins maybe not much to you but viewing his lit-up face and then seeing others in cars nearby also contribute is not only an important glimpse of the positivity this world needs right now, but also an appropriate lesson we can all teach our children.

On a more community-based level, just your simple “lobster” (nickname for the $20 note) can pass through many market vendor sites as a basic mechanism for trade. Say you and your family head off to your local market and skip breakfast. You nose directs you straight to the food truck which is making bacon and egg rolls which you get enough of them to feed everyone. The last thing you want on this fine weathered Sunday is anyone (including children) to be hangry... As you hand over your “lobster” to the food truck, one of the vendors realizes they are running low on farm eggs, she goes off to the local chicken man and grabs another 3 dozen (because the market is getting busy), the chicken farmer receives the lobster and realizes that he probably needs a bit of an energy hit through waking up so early throughout the week, so he goes off to the local juicer and gets a Sunshine Snap off Denise the local juice lady consisting of the most vibrant organic tropical fruits the local region has to offer. She, later in the day, realizes she is out of carrots! Quick, off to one of the growers to grab some more. Whilst here, she gets a couple of other things for the coming week at home. Towards the end of the day the farmers look at what they have left. Basically, some potatoes, a pumpkin and other things, plenty for a family roast. They head to the mobile butcher and purchase a roast lamb for dinner. What a sense of community! An amazing amount of social interaction takes place as well as everyone helping out each other in such turbulent times within our economy. Everyone wins in this situation.

Are there other things that can be done to keep cash within the community? Of course, and it comes back to one relatively simple concept. Most of us who are over 40 can remember how we lived in the past. We all remember cash at the tuck shop at school, mowing the lawn, washing the car all for pocket money. Where for the first time in our lives we got control over our choices and had to make decisions dependent on how much money we had in our piggy banks. Do you remember when you went out on the town, you had to try and save some cash so you could get home. The memory maybe blurry, but before Taxi's had EFTPOS you would need cash to get home and using an ATM after midnight was certainly a challenge at times after a big night on the sauce. Taxis still accept cash, no app, no location settings turned on, no data sent off to an overseas database.

The big data of major corporations who are always searching for more ways to streamline their business is interrupted and believe it or not, there is nothing wrong with that. Why? We have all been sitting around at home, looking at our phones interrupted by adds regarding puppies, or camping gear merely because we have mentioned it in conversation earlier within hearing distance of our devices. Avoiding large corporations and spending cash at local businesses also takes away the data from rewards programs who will encourage you to shop certain ways which in tune suits their supply chain. Online shopping is a fine example of this with basic real time data uploaded to the big businesses server or cloud-based systems. This further pushes out the small and medium businesses.

What about those products which mainly only the big corporations supply? You can really throw the dataset out by sharing rewards systems among your family and friends to claim points. Perhaps have just one program between several people as we all could do with the little amount they give back for your data. As Gavin Jackson, the author of “Money In One Lesson” suggests via a ABC article written back in March 2022; “Everything you buy, and sell is observed by the person who's transferring it through the system.

When money goes online”, Jackson continues “It becomes information, and that information is very valuable”.

Digitization of money sold through convenience only suits the ones pushing it. Corporations and Governments. There are growing concerns this is a building block for a system of increased surveillance. Purchases the government does not agree with along with the flip side to this suggesting what we are to buy is a slippery slope for our democracy. As governments are meant to be there to provide us with a safe, healthy, free and just society we in turn reward them with our taxes. It's up to you to decide if you are getting bang for your buck? Are those hard earned “Jolly Green Giants” ($100 bills) getting your roads fixed? Is the health system coping with demand? Are these highly paid members of parliament working to the value of what we are providing them? The power is in your purchase and that occurs every day. Spend wisely.

As always, I would love to know your thoughts on this specific topic. There are other sub stacks you can also read and comment on. Please feel free to also share these among your friends. Information within this sub stack is also listed below if you would like to do some further reading. I hope you have enjoyed this article.

Luke Hart

News articles in date order:

Here are the answers to five questions about money you probably haven't asked

By Simon Leo Brown and Kate Macdonald (Friday 18th March 2022)

Australians are hoarding more banknotes but how far away is a cashless society in a digital world?

By Nassim Khadem (Thursday 5th January 2023

Cairns Regional Council overturns decision to go cashless after residents rally

By Kristy Sexton-McGrath (Wednesday 19th April 2023

Thought Provoking Luke. Thanks for writing. x